Risk Mitigation Tracked Through ESG Reporting

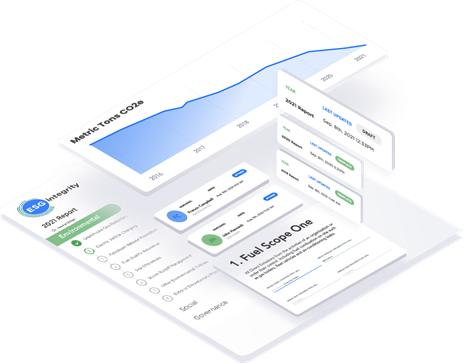

As the Environmental, Social, and Governance (ESG) movement began to garner more headlines in the media, the Fuels Institute board formed a task group to discuss the potential impacts on those in the transport and fuels industries. Noting that the transportation sector is the largest contributor to greenhouse gas (GHG) in the U.S., our board moved forward with gathering more information, while building an application that can provide guidance and reduce costs.

What is ESG Reporting?

ESG reporting is a method for organizations to track and report their operations and risks. This method goes beyond traditional corporate sustainability reports, which consistently lack the tracking and reporting of metrics. When done properly, an ESG report will help a tank owner assess different types of risks including limiting liabilities, improving operating expenses, and both attracting new clients and maintaining existing ones. Convenience store operators engaging in ESG planning and reporting have also noted improved employee relations and an increased ability to attract new employees due to transparent reporting that often mirrors the ideologies of prospective employees.

Although ESG reporting also includes societal and company governance insights, the environmental aspect must be carefully communicated. Under this part of the reporting, the fuel marketer/fleet operator needs to create a transparent and reproducible method for calculating GHG emissions. For this reason, the Fuels Institute’s ESG Integrity platform models emissions by using the Argonne National Laboratory’s GREET model. The application is overseen and updated annually by third parties. It also generates individual emission reports to share with associated companies, as well as prospective business partners.

Who should consider using the ESG Application?

Creating an ESG plan does not have to be expensive or difficult. It does, however, require company leaders to get behind the process and support the objectives and outcomes and, most importantly, set goals for improving the organization.

ESG reporting is not only for large publicly traded fuel marketers and fleet owners. While privately held companies will not likely be required to create an ESG plan, they may still be asked for ESG information to support a fuel supply contract or in response to new requests for proposals on supply contracts. Additionally, family-owned marketers, looking at passing the company down, find ESG reporting to be an effective tool for understanding the company as a whole.

Starting an ESG reporting program should not feel overwhelming — a tank owners’ baseline report is not intended to impress or be perfect. Rather, the baseline report is the stepping off point where risks, such as petroleum releases, are recognized and goals for improvement designed and implemented. If ESG planning and reporting continues to gather momentum, these reports may become important in future property transactions much like the Phase II environmental site assessments.

Bottom-Line Benefits

Pursuit of an ESG plan is not solely to appease investors and banks. A company can also accrue tangible benefits by pursuing these goals.

An expanding amount of research concludes that “a strong ESG proposition correlates with higher equity returns from both a tilt and momentum perspective.”[1] A review of more than 2,000 studies on the impact of ESG planning and equity returns concluded that 63% revealed a positive correlation, compared to 8% whose findings were negative.[2]

There is a growing body of evidence that connects ESG to demonstrated value benefits and financial returns:

(1) Cost reductions

By adopting ESG principles, particularly those related to sustainability, companies will inherently reduce their energy, water, and raw material costs, with one study pegging the impact at 60% of operating profits.[2] The same report revealed:

- 3M has saved $2.2 billion since introducing its Pollution Prevention Pays program in 1975.

- A water utility is saving $180 million per year as it focuses on energy consumption, among other initiatives.

These results are both intuitive and measurable. Consider an LED lightbulb, for example. Research has evaluated the performance and energy costs over the lifetime of a bulb and a user can extrapolate the results to their operations. This is a more concrete way to evaluate cost savings.

(2) Minimize regulatory and legal interventions

Committing to ESG values can reduce government and legal interference: “A stronger external-value proposition can enable companies to achieve greater strategic freedom, easing regulatory pressure. In fact, in case after case across sectors and geographies, we’ve seen that strength in ESG helps reduce companies’ risk of adverse government action. It can also engender government support.”[2]

On average, one-third of corporations are impacted by state action, from 25%-30% for pharma/healthcare companies to 50%-60% for banks.[3]

(3) Increased productivity

Companies that demonstrate strong corporate social responsibility can stimulate employee productivity, while increasing the retention of favored employees. An analysis of the companies that were featured in Fortune’s “100 Best Companies to Work For” found that they generated up to a 3.8% higher stock return annually compared to their competitors over a 25-year time span.[4]

Recent studies have concluded that employees at companies that demonstrate a commitment to social issues express higher job satisfaction and a stronger motivation to act in a “prosocial” way.[5] In terms of enterprise-wide productivity, “social, environmental, and governance responsibility (to all stakeholders) appear to be important as a competitive factor of the modern firm.”[6]

(4) PR boost

When tied to relevant and timely industry news, a strategic public relations effort that highlights a company’s ESG efforts can generate valuable media attention. They help distinguish between greenwashing efforts and those that detail compelling and meaningful initiatives.

A study of the messaging that companies distributed in response to the COVID-19 pandemic showed that “firms experiencing more positive sentiment on their human capital, supply chain, and operational response to COVID-19 experienced higher institutional money flows and less negative returns.[7]”

(5) Increased access to capital

Companies that offer a thoughtful ESG plan increase their appeal to lenders. Greater transparency around the materiality of ESG issues will increasingly affect access to capital and asset values in high-risk sectors. A growing landscape of sustainability standards and disclosure requirements, that exposes financial flows to greater scrutiny and oversight, is expected to start having more influence on investment decisions at all levels, from banks to asset managers to consumers.[8]

At least one expert quantified the access value, associating a higher ESG score with a 10% savings on capital costs. That expert stated that “The risks that affect your business, in terms of its license to operate, are reduced if you have a strong ESG proposition.”[9]

(6) Increased access to bidding

Companies looking to earn contract bids from public and private companies may fare better with a strong ESG posture. Green procurement, the sourcing of goods and products that are environmentally friendly, is becoming increasingly common. Local, state, and federal government organizations may require suppliers to demonstrate sustainable practices, and private companies may limit responses on their requests for proposals to those who offer some type of sustainability value proposition.[10]

(7) It’s simply the right thing

Finally, companies may pursue an ESG agenda because it aligns with their ethical and moral values. This may be intrinsic in the company’s mission or ancillary to its other pursuits. Either way, embracing practices that preserve and protect the environment, stand up for social issues, and adopt an inclusive governing body help drive corporate decision-making and contribute to the company’s identity and brand.

Looking Ahead

Global opinions on climate change issues have been bolstered by investment groups demanding access to sustainable investment options. In response, the majority of the world’s major financial institutions, who collectively control assets of $130 trillion, have begun requesting that publicly traded companies provide information on E, S, and G metric impacts along with written goals for improving all three in the coming years and decades. Investor groups are looking for transparency in business practices that go beyond the traditional reporting provided by publicly traded companies.

The depth of ESG reporting is already touching fuel marketers and fleet operators as the publicly traded companies begin to demand emissions data from engaged organizations. Much of this data will be included in the company’s ESG report. As transportation makes up 33% of man-made greenhouse gases, fleets are increasingly being required to report their emissions under shipping agreements or for internal agency reporting. Demands for low carbon fuels (primarily higher blends of biofuels) are growing as the U.S. fleet recognizes this is the most immediate path for emissions reductions. As tank owners know, offering higher blends of biofuels takes planning and a strong fuel quality program.

Fuel providers are critical to maintaining the economy and our everyday lives. Maintaining tanks, lines and dispensers is a full-time job, but new demands are being put upon the fuels industry. Driven by climate change impacts, electrified transportation is part of the solution to curbing greenhouse gases. Liquid fuels and combustion engines, however, will be around for decades. Electric vehicle (EV) adoption will not occur equally across the U.S. and charging infrastructure will likely not be installed in areas where EVs do not exist. It is imperative that during this time of transition we do not overlook rural and disadvantaged community needs.

ESG practices and expectations are quickly evolving, making any corporate plan subject to ongoing review and analysis. No matter your industry or practice area, those looking to pursue an ESG initiative can expect more ambiguity than clarity.

Retailers and marketers must understand the ESG scope and requirements of the companies they supply or represent, assessing how their actions impact the ESG reporting of the companies they supply or represent.

Inaction is no longer a viable option. Remaining silent when it comes to ESG speaks volumes about a company’s perceived values. If you have not yet paid attention to ESG, the time is now.

The public is watching. What you say — and do — can make a world of difference.

The Fuels Institute is a non-profit cross-industry group focused on all matters related to fuels and transportation related issues. The Institute does not take positions on legislative or regulatory matters. The Institute creates peer reviewed research on current issues such as fuel quality and transportation emissions reduction. All research goes through a rigorous peer review process. The primary task of the Institute is to recognize barriers to progress and provide unbiased research focused on overcoming those barriers.

[1] Eling Lee, “Can ESG Add Alpha? An analysis of ESG Tilt and Momentum Strategies,” Journal of Investing 25, no. 2 (Summer 2015): 113–24, https://doi.org/10.3905/joi.2016.25.2.113.

[2] Witold Henisz, Tim Koller, and Robin Nuttall, “Five Ways That ESG Creates Value,” McKinsey Quarterly, McKinsey & Company. November 14, 2019, https://www.mckinsey.com/business-functions/strategy-and-corporate-finance/our-insights/five-ways-that-esg-creates-value.

[3] Henisz, “The Costs and Benefits of Calculating the Net Present Value of Corporate Diplomacy.”

[4] Alex Edmans, “The Link Between Job Satisfaction and Firm Value, with Implications for Corporate Social Responsibility,” Academy of Management Perspectives 26, no. 4 (November 1, 2012): 1-19, https://doi.org/10.5465/amp.2012.0046.

[5] Jan-Emmanuelde Neveetal, “Work and Well-being: A Global Perspective,” in Global Happiness Policy Report, ed. Jeffrey Sachs (New York, NY: Global Council for Happiness and Wellbeing, 2018), 74–127; Adam Grant, “Does Intrinsic Motivation Fuel the Prosocial Fire? Motivational Synergy in Predicting Persistence, Performance, and Productivity,” Journal of Applied Psychology 93, no. 1 (January 2008): 48–58, https://doi.org/10.1037/0021-9010.93.1.48; Adam Grant, “Relational Job Design and the Motivation to Make a Prosocial Difference,” Academy of Management Review 32, no. 2 (April 2007): 393–417, https://doi.org/10.5465/amr.2007.24351328; and Jeffery Thompson and Stuart Bunderson, “Violations of Principle: Ideological Currency in the Psychological Contract.” Academy of Management Review 28, no. 4 (October 2003): 571–86, https://doi.org/10.5465/amr.2003.10899381.

[6] Marco Taliento, Christian Favino, and Antonio Netti, “Impact of Environmental, Social, and Governance Information on Economic Performance: Evidence of a Corporate ‘Sustainability Advantage’ from Europe,” Sustainability 11, no. 6 (March 2019): 1738, https://doi.org/10.3390/su11061738.

[7] State Street Corporation, Corporate Resilience and Response During COVID-19, 2020, https://www.statestreet.com/content/dam/statestreet/documents/ss_associates/Corporate%20Resilience%20and%20-Response%20During%20Covid19_Exec_2020April_3049915.GBL.pdf

[8] Moody’s Investors Service Inc., “Moody’s — Global ESG Trends Amplified by Green Stimulus, Climate Policy and Disclosure Initiatives,” news release, February 3, 2021, https://www.moodys.com/research/Moodys-Global-ESG-trends-amplified-by-green-stimulus-climate-policy–PBC_1264125.

[9] Sean Brown, Sara Bernow, and Robin Nuttall, “Why ESG Is Here to Stay,” May 26, 2020, in Inside the Strategy Room, produced by McKinsey & Company, podcast episode transcript, https://www.mckinsey.com/business-functions/strategy-and-corporate-finance/our-insights/why-esg-is-here-to-stay.

[10] Tom Permatteo, “Sustainable Sourcing: How to Demonstrate Sustainability and Win More Contract Bids,” Green Business Bureau (company blog), February 19, 2021, https://greenbusinessbureau.com/blog/sustainable-sourcing-how-to-demonstrate-sustainability-and-win-more-contract-bids/.